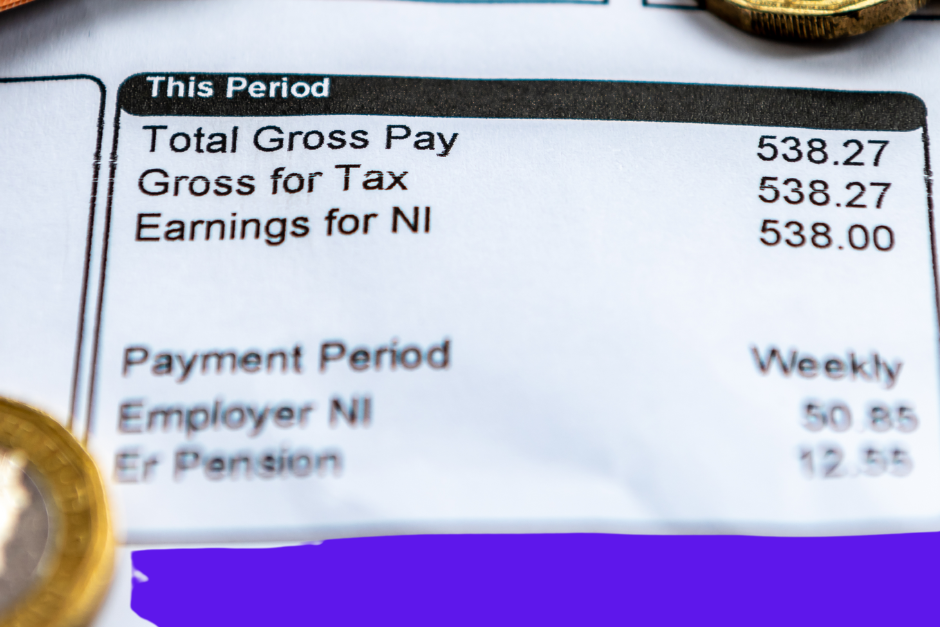

As an employer, payroll is more than just a routine task; it is a crucial aspect of running a successful business. Here's what payroll means to

Key features to consider include automated calculations for wages and deductions, compliance management, superannuation administration, employee self-service portals, integration with accounting systems, and comprehensive reporting and analytics.

Yes, many payroll service providers offer integration with popular accounting systems like Xero, MYOB, and QuickBooks. This integration streamlines financial management, allowing for seamless data flow between payroll and accounting functions.

The cost of payroll services varies based on factors such as the number of employees, the complexity of payroll needs, and the features required. Some providers offer tiered pricing models, while others may charge per employee or transaction.